President Ranil Wickremesinghe has extended an invitation to the Opposition Leader and other Opposition party leaders to engage in discussions with senior IMF officials before the disbursement of the third tranche of the International Monetary Fund (IMF) loan to Sri Lanka. However, there has been no positive response from the main opposition leaders. Despite this, they have failed to propose any alternative solutions to address the significant economic crisis facing Sri Lanka.

Numerous rounds of negotiations spanning a year were conducted to avert what could potentially be the worst economic catastrophe in Sri Lanka’s post-independence history. Consequently, an Extended Fund Facility was agreed with the IMF in late March 2023. This agreement stipulated fulfilling various pre- and post-conditions, demonstrating their efficacy to the global community, thereby securing the second tranche of the IMF loan.

Following the receipt of the second tranche, President Ranil Wickremesinghe, in his capacity as National Policy and Finance Minister invited Opposition Leader Sajith Premadasa and other responsible opposition party leaders to partake in discussions with IMF officials regarding the subsequent tranche. Notably, President Wickremesinghe emphasised this appeal, particularly to opposition leaders, given their claim to be able to modify the agreement as per their requirements. Hence, a prime opportunity has arisen to present alternative proposals to IMF officials, and accountable leaders must contribute meaningfully to these deliberations.

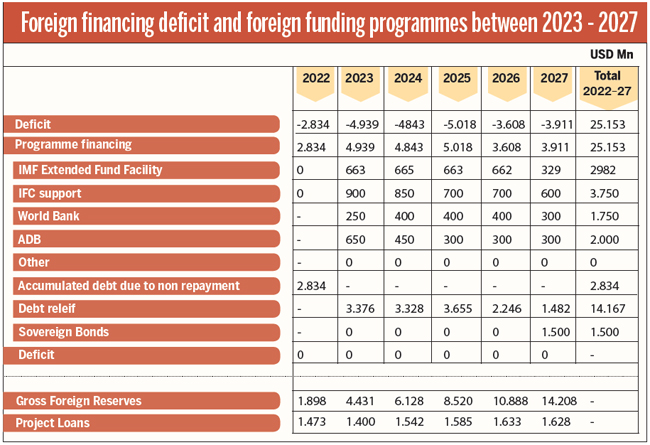

The primary objective of the signed IMF Agreement entails a forty-eight-month program aimed at reforming Sri Lanka’s public financial management processes, particularly concerning debt sustainability. This program is intended to support the state budget and bolster foreign reserves. As per the agreement, maintaining a surplus in the public budget’s primary account is essential to ensure debt sustainability. Accordingly, the budget deficit should be capped at five per cent or lower of the gross domestic product.

By 2032, the total outstanding foreign debt must be reduced to 95% or less of the gross domestic product. The central government’s annual gross financial requirement from 2022 to 2027 should amount to 13% of the average gross domestic product, decreasing to 4.5% from 2027 to 2032. To achieve these targets, foreign debt restructuring programs have been formulated to repay outstanding loans from 2028 onwards. These restructuring programs necessitate the repayment of 37% of the debt stock within the next five to six years, followed by gradual repayment over subsequent years. Failure to adhere to these obligations could jeopardise international agreements and exacerbate the balance of payments crisis, leading to severe repercussions such as shortages of essential goods and transportation disruptions.

Finance Committee Chairman Dr. Harsha de Silva underscores the seriousness of the situation, emphasising that it transcends mere political concerns and demands a rigorous, scientifically informed approach.

However, Opposition Leader Sajith Premadasa and his supporters lack the requisite comprehension of these complex economic issues, opting instead for populist rhetoric. Yet, navigating the current economic crisis requires astute and visionary leadership grounded in reality.

A table detailing the foreign financial gap from 2022 to 2027 accompanies this article, providing further insights into the prevailing economic challenges.